Continuity

While CLOBs are often referred to as continuous markets because trades can happen at any moment, in a GLOB, they can start, stop and finish at any moment, such that even the execution (the volume traded) in itself is continuous.

The so-called continuous markets are discontinuous in the sense that time matters not proportionally to how much of it has passed, but by the order of trades, which is highly problematic.

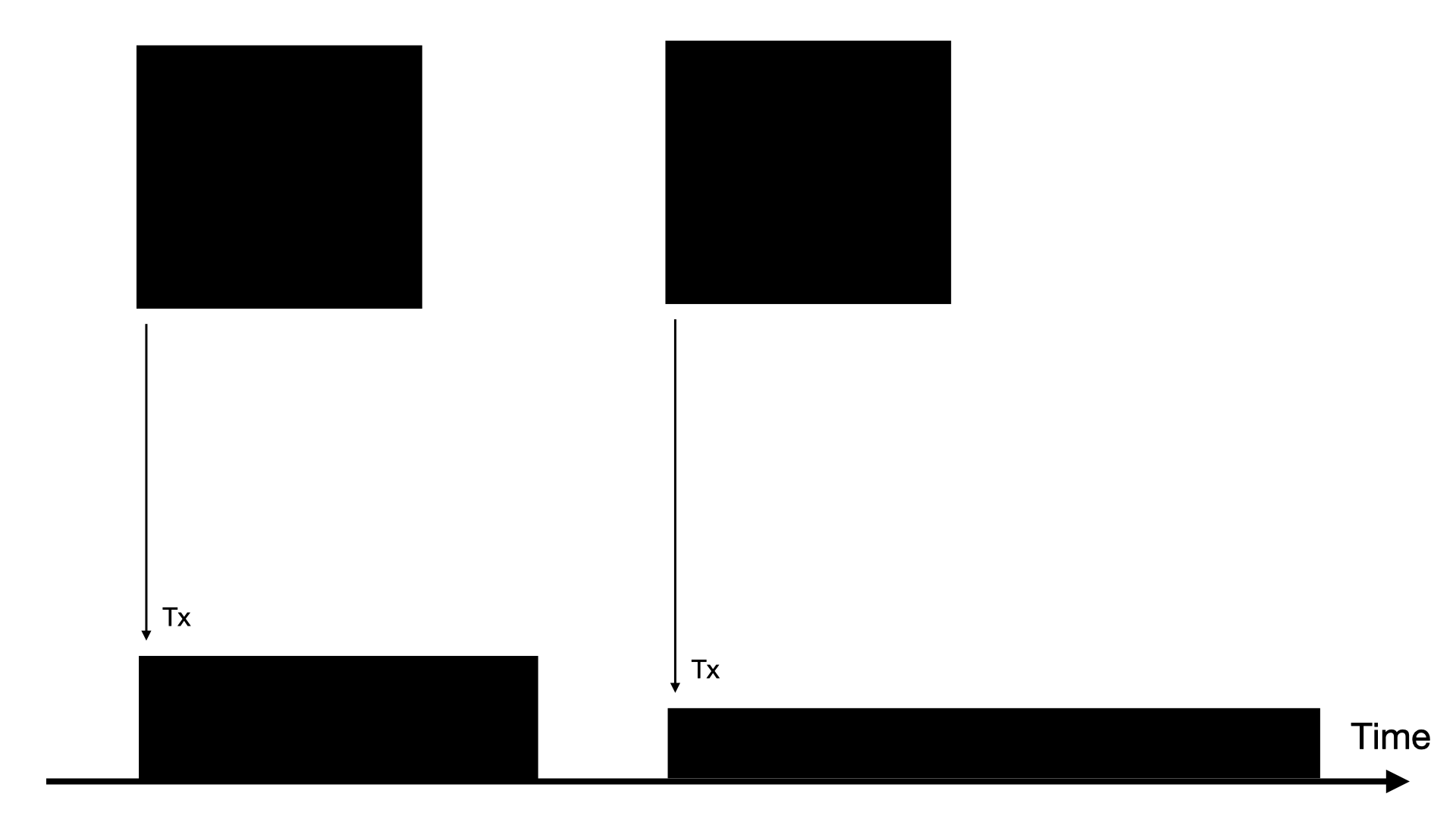

Frequent Batch Auctions

Frequent Batch Auctions (FBAs) are a previous attempt of market microstructure research to smooth markets by setting a minimum time scale on which trades can happen.

FBAs disable some HFT by a combination of two elements: stopping execution of trades within batches to aggregate intents, and hiding the state of the market apart from the price of each sudden clearing happening at the end of each batch. As a consequence, they are less continuous than CLOBs, and inefficient due to the sealing that is necessary to avoid new and often worse extractive strategies.

In comparison, GLOBs are more continuous than CLOBs, while still removing the core problem of inflated importance of time ordering.

Trading speed

Furthermore, GLOBs do not have to make a tradeoff choosing any particular smoothing time constant. Instead, they allow for users to choose their speed. GLOBs even allow for very slow execution when desired (for TWAPs, DCA and for derivatives markets with natural time scale set by an expiration date).

GLOBs are far more transparent for MMers than FBAs and even CLOBs, allowing them to compete in the open by matching large orders after the flow is known and reducing inventory risk (no stale-quote sniping / adverse selection).